does idaho have inheritance tax

1 2005 contact us in the Boise area at 208 334-7660 or toll free at 800 972-7660. This increases to 3 million in 2020 Mississippi.

Why Live In Teton Valley Idaho

All of these debts must be paid off.

. Idaho also does not have an inheritance tax. Keep in mind that if you inherit property from another state that state may have. 4 The federal government does not impose an inheritance tax.

Differences Between Inheritance and Estate Taxes. The top estate tax rate is 16 percent exemption threshold. Maryland is the only state to impose both now that New Jersey has repealed its estate tax.

A federal estate tax is in effect as of 2021 but the exemption is significant. Idaho Inheritance and Gift Tax. Even though Idaho does not collect an inheritance tax however you could end up paying.

For more details on Idaho estate tax requirements for deaths before Jan. 117 million increasing to 1206 million for deaths that occur in 2022. Inheritance laws from other states may apply to you though if a person who lived in a state with an inheritance tax leaves something to you.

Based on changes to the tax law in early 2018 married couples now need to have over 24000 in tax. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. Idaho residents do not need to worry about a state estate or inheritance tax.

The US does not impose an inheritance tax but it does impose a gift tax. No estate tax or inheritance tax. No estate tax or inheritance tax.

Idaho does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax. Idaho Inheritance and Gift Tax. In other words the estate itself can be taxed for the amount that is above the exemption cut-off.

Its essential to remember that if you inherit property from another state it may be subject to that states specific inheritance or estate tax. However like all other states it has its own inheritance laws including the ones that cover what. To fully understand the differences between these two types of taxes its important to first understand what each tax entails.

In regards to an estate tax your estate is defined by the total of your debts and possessions that are left behind when you die. In Kentucky for instance the inheritance tax applies to all in-state property even for out-of-state inheritors. Section 15-2-102 permits a surviving spouse to inherit the decedents entire estate if the decedent did not have children and her parents are deceased.

No estate tax or inheritance tax. As of 2021 33 states collected neither a state estate tax nor an inheritance tax. Idaho might be the most tax-friendly state for those who inherit an estate there.

Overall Idaho tax structure. Idaho is considered a tax friendly state. Idaho does not currently impose an inheritance tax.

Idaho does not have an estate or inheritance tax. How Long Does It Take to Get an Inheritance. No estate tax or inheritance tax.

A decedents heirs are entitled to inherit her estate according to Idaho statute 15-2-101 when she dies without a will. There is no federal inheritance tax but there is a federal estate tax. As of 2004 the Gem State has neither inheritance nor estate taxes often referred to as death taxes However Idaho residents are often not aware that sometimes they do have to face taxes when they inherit property.

Idaho does not have an estate or inheritance tax. Idaho has no gift tax or inheritance tax and its estate tax expired in 2004. The top estate tax rate is 16 percent exemption threshold.

Also gifts of 15000 and below do not require any tax payment or estate tax return. According to the Oregon Department of Revenue the tax is called the Oregon Estate Transfer Tax. Idaho does not currently impose an inheritance tax.

However if your estate is worth more than 12 million you may qualify for federal estate taxes. If you live in Oregon you can be happy that you dont have to pay both an estate tax and inheritance tax like people in Maryland. The Gem State has no estate or inheritance tax so unless your estate qualifies for the federal estate tax the exemption threshold is 1206 million for 2022 you don.

The gift tax exemption mirrors the estate tax exemption. Also gifts of 15000 and below do not require any tax payment or estate tax return. Ad The Leading Online Publisher of National and State-specific Probate Legal Documents.

On the other hand you may owe an estate tax and the threshold of 1 million is relatively low. 952 White Plains NY 10606. It does not tax Social Security but it does tax.

Idaho does not levy an inheritance tax or an estate. Even though Idaho does not collect an inheritance. The beneficiary of the property is responsible for paying the tax him or herselfâ.

The Oregon Estate Tax. If the total value of the estate falls below the exemption line then there is no estate tax applied. No estate tax or inheritance tax.

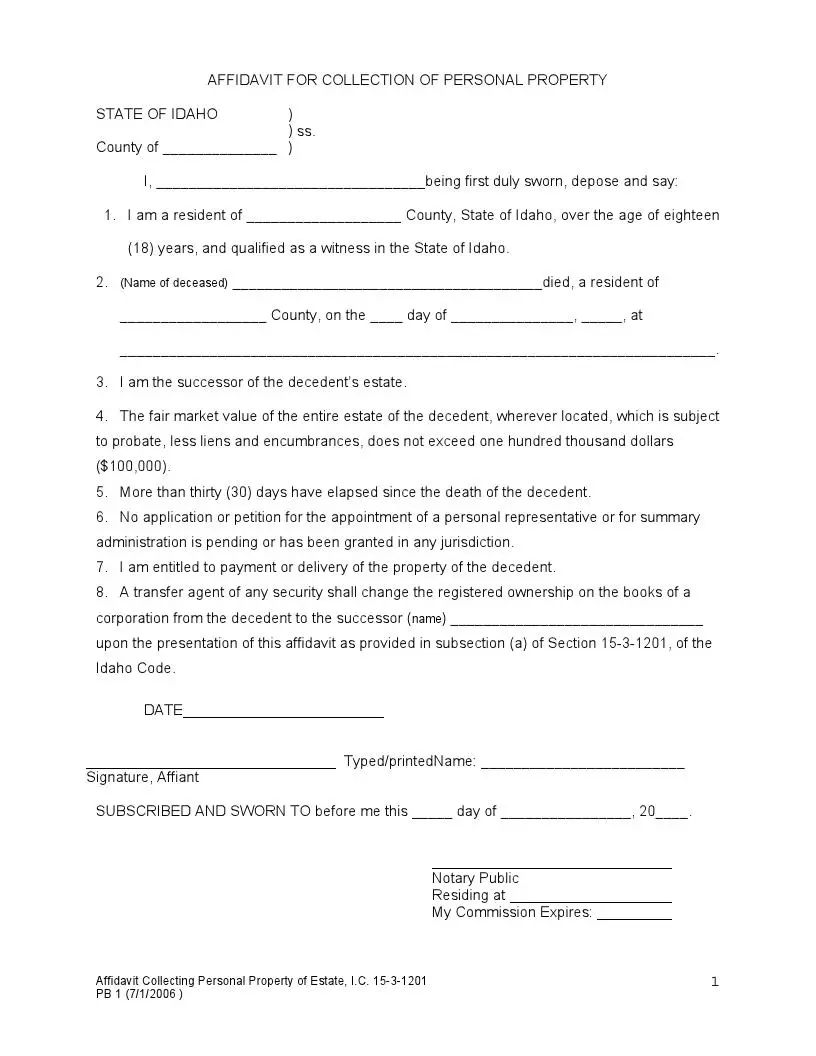

Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. The inheritance tax is a tax on the beneficiarys gift. States Without Death Taxes.

A decedents heirs are entitled to inherit her estate according to Idaho statute 15-2-101 when she dies without a will. Page last updated May. Idaho does not levy an inheritance tax or an estate tax.

Our Idaho retirement tax friendliness calculator can help you estimate your tax burden in retirement using your Social Security 401k and IRA income.

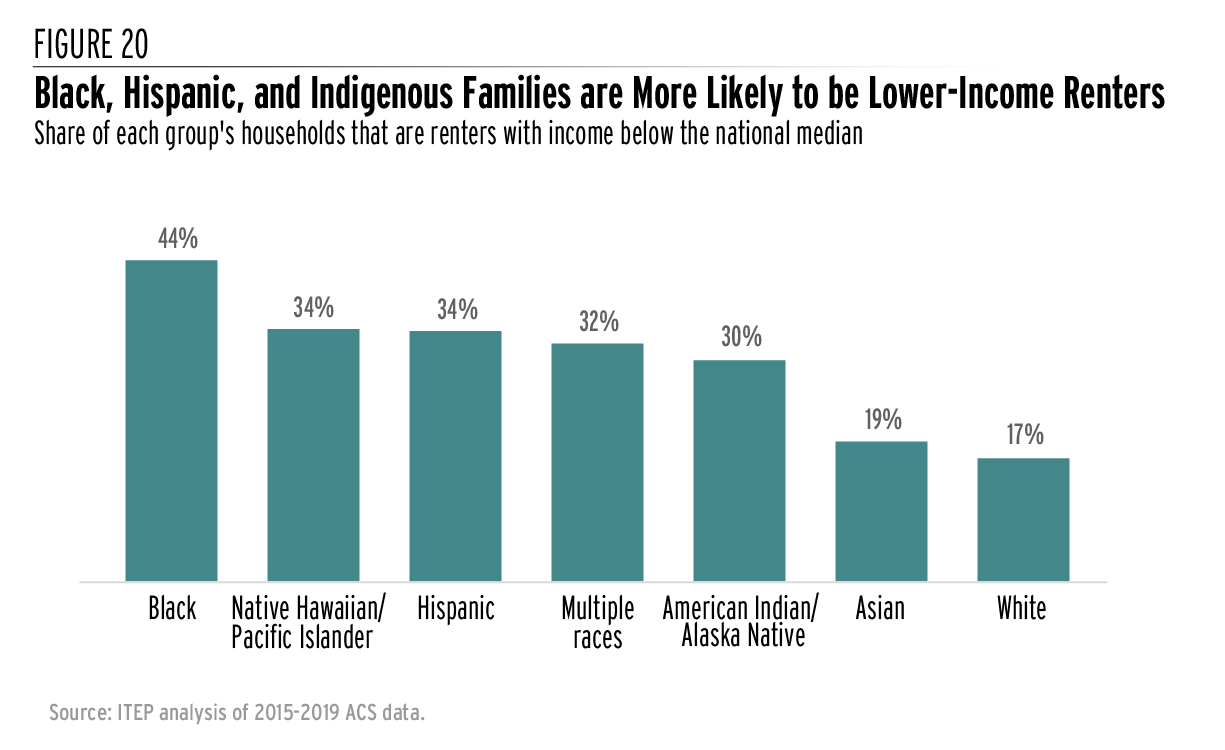

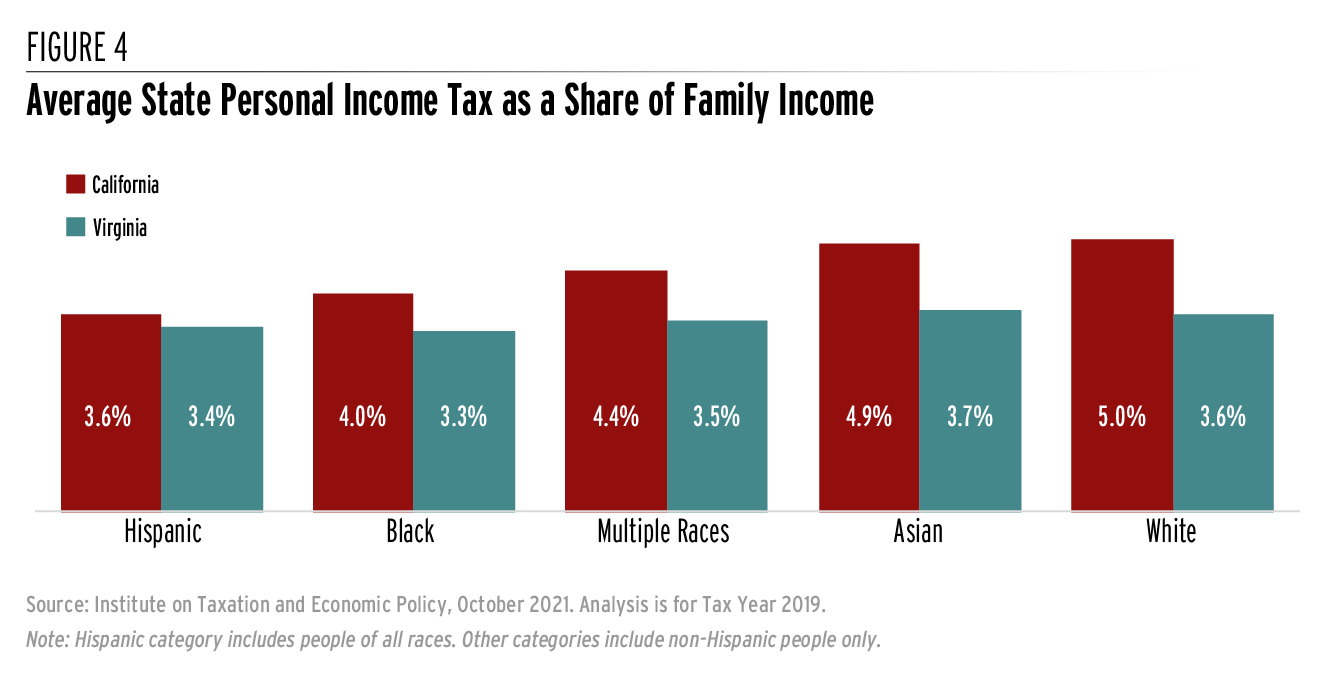

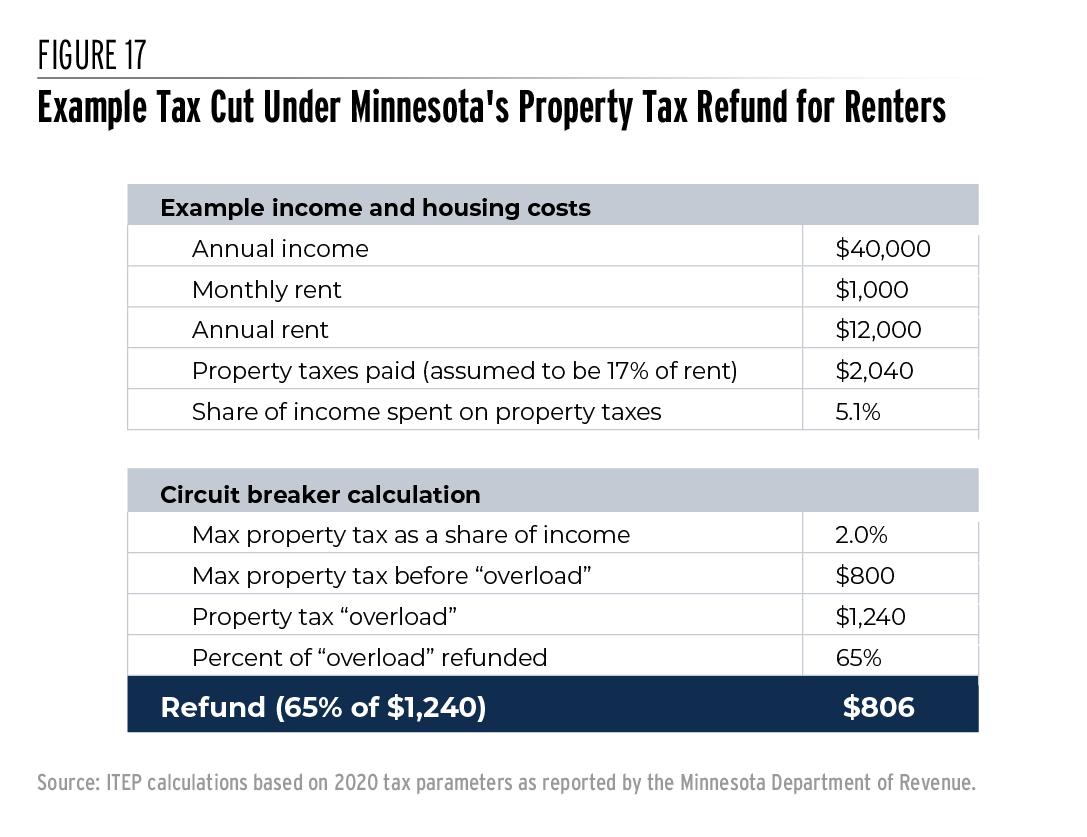

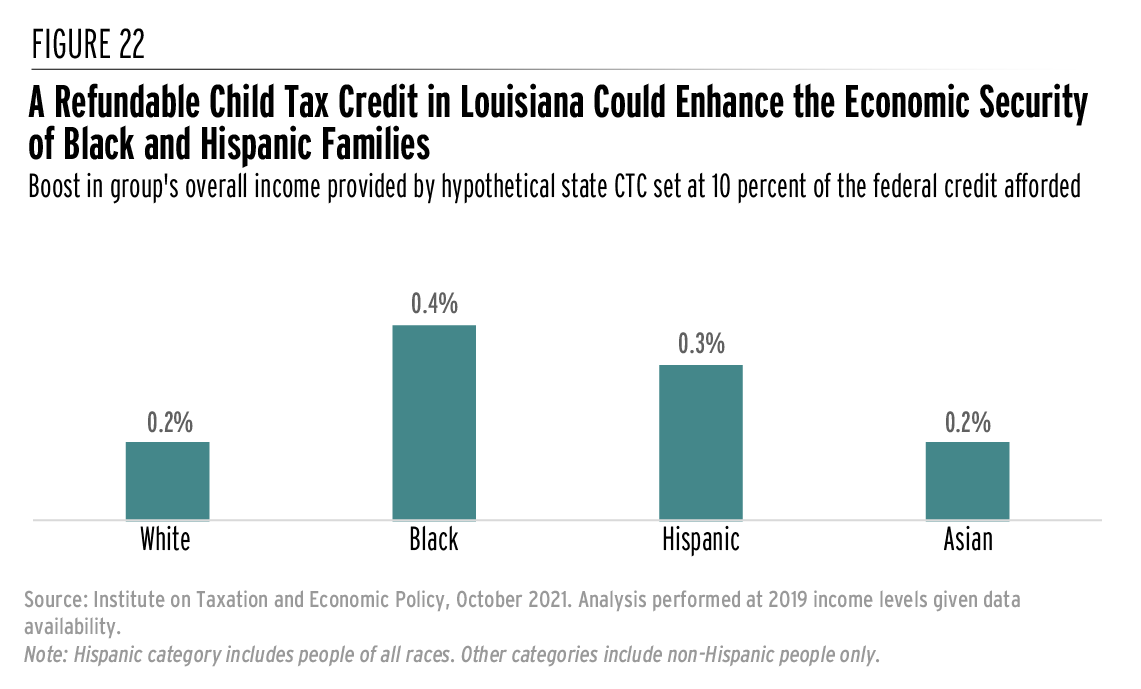

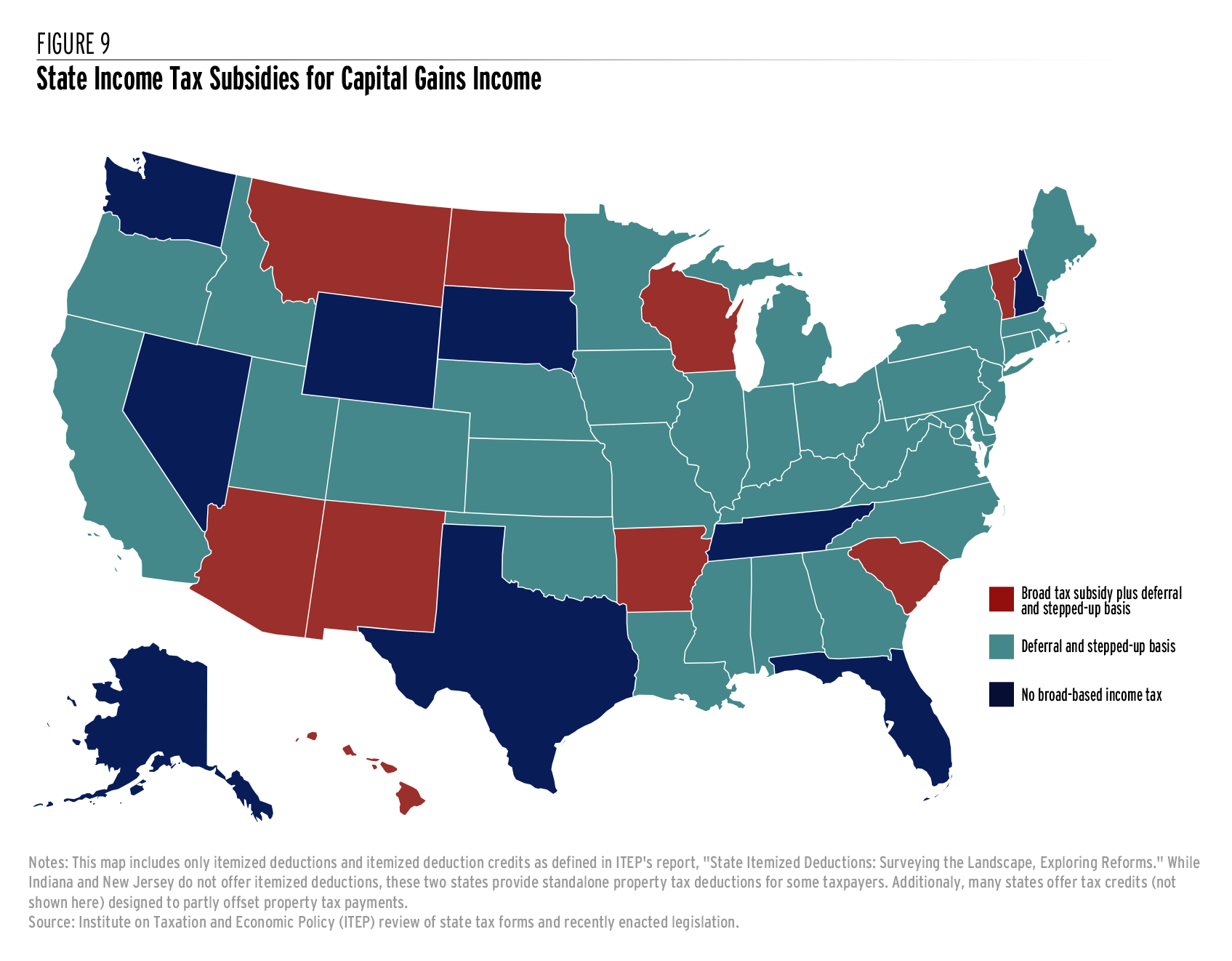

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Idaho Last Will And Testament Legalzoom

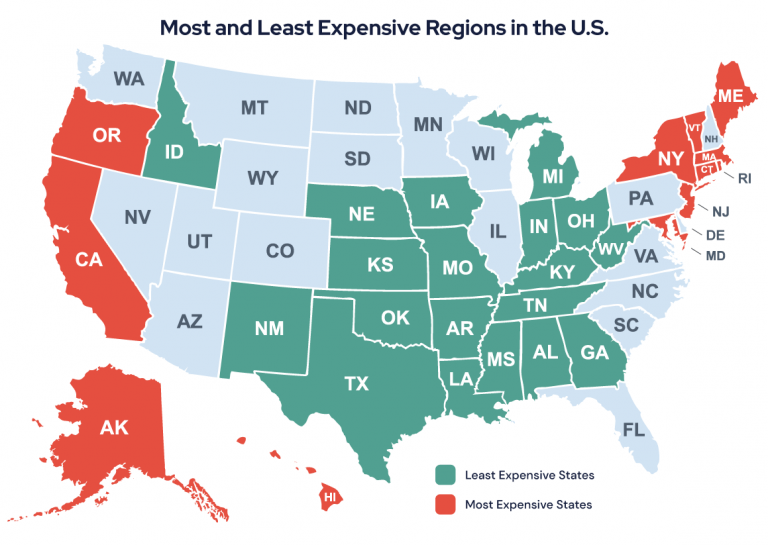

High Tax States Americans Fled In 2021 And Where They Moved

Idaho Retirement Guide Idaho Best Places To Retire Top Retirements

Nebraska And Iowa Groups Call For Uniform Approach To Job Licensing

Higher Education Expenditures Urban Institute

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Community Property States List Vs Common Law Taxes Definition

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Free Idaho Small Estate Affidavit Form Pdf Formspal

Best Worst States To Retire In 2022 Guide

State Estate And Inheritance Taxes Itep

Boise Probate Lawyer Protect Your Family S Property

Estate Planning Archives Evergreen Elder Law